Investor Support Services

Your guide to Property Investment in Christchurch

Smart Choices for Savvy Investors

Whether you're a seasoned investor or just starting out, navigating the rental property market can feel overwhelming. That’s why we’ve created this guide, to simplify the journey, answer your questions, and help you make confident, informed decisions.

At First National Progressive, we work with property investors across Christchurch to maximise returns, reduce stress, and protect their investments.

But this isn’t a sales pitch, it’s a resource. Inside, you’ll find:

- Insights into Christchurch’s rental market

- Tips on choosing the right investment property

- Advice for private landlords

- Answers to common investor questions

- A free rental health check offer

- Suburbs to keep an eye on

We believe in empowering investors with knowledge. Whether you manage your own property or work with a professional team, this guide is here to support you.

Let’s dive in and explore how to make your investment work smarter, not harder.

Why Invest in Christchurch?

Christchurch has quietly become one of New Zealand’s most promising property investment hot spots. With a unique mix of affordability, growth potential, and lifestyle appeal, it’s no wonder more investors are turning their attention to the Garden City.

Following the earthquakes, Christchurch has undergone a massive transformation. Billions have been invested in infrastructure, commercial hubs, and residential developments. The result? A modern, well planned city with strong foundations, literally and economically.

Compared to Auckland and Wellington, Christchurch offers significantly lower property prices, making it easier for first time investors or those looking to expand their portfolio. You can often find high quality homes or townhouses in desirable suburbs for a fraction of the price you'd pay in other major centres.

With a steady influx of students, professionals, and families, the rental market remains strong. The presence of institutions such as the University of Canterbury and Ara Institute ensures a consistent demand for well located rental properties.

Christchurch offers a unique blend of lifestyle, urban convenience, access to the outdoors, and a strong sense of community. For tenants, this means long term appeal. For investors, it means lower turnover and more stable returns.

Christchurch continues to offer some of the most attractive rental yields in New Zealand. With a city wide average sitting around 4.36%, savvy investors can find even better returns in select suburbs that combine affordability, tenant demand, and long term growth potential.

What Type of Property Should You Buy?

Choosing the right rental property is one of the most important decisions an investor can make. The type of property you buy will influence your rental income, tenant profile, maintenance costs, and long term capital growth. Christchurch offers a diverse range of options, each with its own pros and cons.

Pros: Cons:

Appeal to families and long term tenants Higher purchase price

Larger land size potential for future development More maintenance (gardens, fencing, etc.)

Often located in established suburbs with good schools Lower yield compared to multi unit options

Best for: Investors focused on capital growth and long term stability.

Pros: Cons:

Lower maintenance Smaller living spaces

Popular with young professionals and couples Body corporate fees (if applicable)

Often newer builds with modern amenities

Best for: Investors seeking a balance between yield and growth, with minimal upkeep.

Pros: Cons:

Affordable entry point Limited capital growth

High demand in central locations Higher turnover of tenants

Easy to manage Body corporate fees and shared facilities

Best for: Short term investors or those focused on cash flow.

Pros: Cons:

High rental yield potential Higher wear and tear

Multiple income streams from one property More management required

Strong demand near universities and polytechs Seasonal vacancy risk

Best suited for: Experienced investors or those utilising professional property management services.

When choosing a property, location is key. Here are a few things to look for:

-

Proximity to schools, transport, and shops

-

Low vacancy rates

-

Tenant demographics (families, students, professionals)

-

Future development plans in the area

Before buying, ask yourself:

-

What kind of tenants do I want?

-

Am I focused on yield, growth, or both?

-

Do I want to manage the property myself or use a property manager?

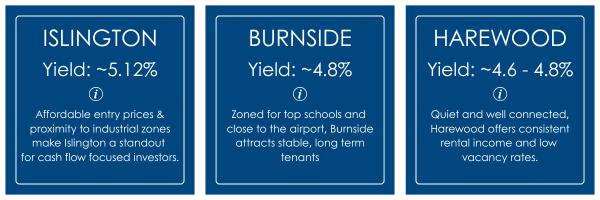

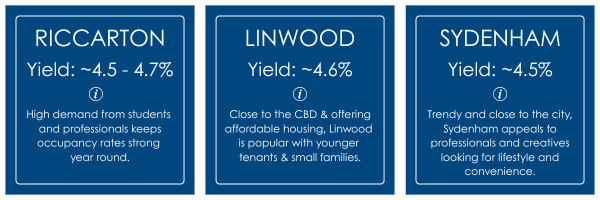

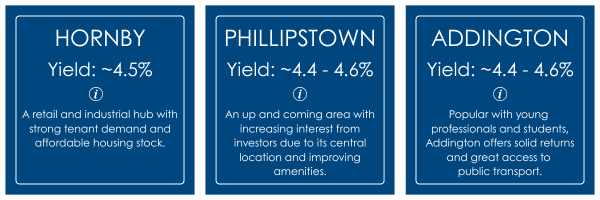

Suburbs to Look Out For

Christchurch continues to offer some of the most attractive rental yields in New Zealand. With a city wide average sitting around 4.36%, savvy investors can find even better returns in select suburbs that combine affordability, tenant demand, and long term growth potential.

Here are 10 of the best performing suburbs for rental yield:

Disclaimer:

Rental yield data and suburb performance insights referenced in this guide are sourced from CoreLogic, a trusted provider of property market analytics. We subscribe to CoreLogic’s services to ensure our advice is based on accurate, up-to-date information. Figures are indicative only and may vary depending on property type, condition, and market fluctuations.

Understanding Rental Yields

Rental yield is one of the most important metrics for property investors. It helps you understand how much income your property is generating relative to its value, and whether your investment is working for you.

What Is Rental Yield?

Rental yield is the percentage return you earn from renting out a property. It’s calculated using the annual rental income divided by the property’s value.

Formula:

Gross Rental Yield =

(Annual Rent÷Property Value)×100(Annual Rent÷Property Value)×100

For example:

If a property is worth $600,000 and earns $600 per week in rent:

Annual Rent = $600 × 52 = $31,200

Yield = (31,200 ÷ 600,000) × 100 = 5.2%

Gross vs Net Yield

- Gross Yield: Based only on rent and property value. It’s a quick way to compare properties.

- Net Yield: Takes into account expenses like rates, insurance, maintenance, and management fees. This gives a more accurate picture of your actual return.

What’s Considered a “Good” Yield?

This depends on your investment goals:

- 4 - 5%: Balanced properties with both yield and capital growth potential.

- 5 - 6%+: Strong cash flow properties, often in more affordable suburbs.

- Below 4%: May indicate high value areas with slower rental returns but strong long term growth.

Factors That Influence Yield

- Location: Suburbs with high demand and low vacancy rates tend to offer better yields.

- Property Type: Townhouses and multi tenancy homes often yield more than standalone houses.

- Tenant Profile: Students, professionals, and families have different rental expectations and turnover rates.

- Market Conditions: Interest rates, supply and demand, and local development all play a role.

Yield vs Capital Growth: Finding the Balance

Some investors focus on yield for immediate cash flow. Others prioritise capital growth, the increase in property value over time. The best strategy often involves a mix of both, depending on your financial goals and risk tolerance.

FAQs for Investors and Private Landlords

Whether you're managing your own rental or working with a property manager, questions come up. Here are answers to some of the most common queries we hear from investors and landlords across Christchurch.

Property management fees typically range from 7–10% of the weekly rent, depending on the level of service. Some providers also charge for inspections, letting fees, or maintenance coordination. It’s important to understand what’s included and compare value, not just price.

If rent is missed, the process usually involves:

- Prompt follow up with the tenant

- Issuing formal notices if required

- Lodging with the Tenancy Tribunal if unresolved

Professional property managers have systems in place to handle arrears quickly and legally, helping protect your income.

Routine inspections are typically carried out every 3 - 4 months. These help ensure the property is being looked after, identify maintenance issues early, and keep a record of the property’s condition. Check your Landlord Insurance Policy for their requirements.

Ingoing and Vacating inspections are also required in between tenancies.

Successful tenant selection involves:

- Advertising on industry backed, quality websites and publications

- Holding viewings. Meeting and interviewing prospective tenants

- Thorough background and credit checks

- Employment and rental history verification

Good tenants reduce risk, protect your property, and improve long term returns.

Not at all. A good property manager works with you, not instead of you. You’ll still make key decisions, like approving tenants, setting rent, and authorising repairs, but without the day to day stress.

Landlords must comply with:

- Healthy Homes Standards

- Residential Tenancies Act

- Bond lodgement and rent records

- Maintenance and safety obligations

Staying compliant protects you from fines and ensures your property remains attractive to tenants.

Advice for Private Landlords

Managing a rental property yourself can be rewarding, but it also comes with responsibilities and risks. Whether you're new to land lording or have years of experience, here are some key tips to help you protect your investment and keep things running smoothly.

1. Know Your Legal Obligations

As a landlord, you’re required to comply with:

- Healthy Homes Standards (heating, insulation, ventilation, moisture, and draught control)

- Residential Tenancies Act

- Bond lodgement and rent record keeping

Staying compliant not only protects your tenants, it protects you from fines and disputes.

2. Screen Tenants Thoroughly

Choosing the right tenant is one of the most important decisions you’ll make. Always:

- Check references and rental history

- Verify employment and income

- Run credit checks if possible

A good tenant means fewer issues, better care of your property, and more consistent rent payments.

3. Schedule Regular Inspections

Routine inspections (every 3 months) help you:

- Spot maintenance issues early

- Ensure the property is being looked after

- Keep a record of the property’s condition

Always give proper notice and document your findings.

4. Stay on Top of Maintenance

Prompt repairs show tenants you care and help prevent small issues from becoming costly problems. Keep a budget for:

- Plumbing and electrical fixes

- Appliance servicing

- Exterior upkeep (gutters, fencing, etc.)

5. Review Rent Regularly

Market conditions change. Reviewing your rent annually ensures:

- You’re not under or over charging

- Your property remains competitive

- You’re aligned with current market rates

Just make sure any increases follow legal guidelines and are communicated clearly.

6. Keep Records and Documentation

Maintain clear records of:

- Rent payments

- Inspection reports

- Maintenance and repairs

- Communication with tenants

This protects you in case of disputes and helps with tax and compliance.

7. Know When to Ask for Help

Managing a rental property can be rewarding, but it also comes with its share of challenges. From keeping up with legal requirements to handling tenant issues and maintenance, it’s easy for things to become time consuming and stressful.

That’s why many landlords choose to work with a professional property management team. At First National Progressive, our full management service is designed to reduce the pressure and help you get the most out of your investment. We take care of the day to day responsibilities so you can focus on the bigger picture, whether that’s growing your portfolio or simply enjoying peace of mind.

Even if you’re not sure whether full management is right for you, we’re always happy to chat and explore how we can support your goals.

Free Rental Health Check

What Is a Rental Health Check?

It’s a no obligation assessment of your rental property documentation & compliance. We look at:

- Review of current rent vs. market rent

- Assessment of tenancy agreements and extensions

- Review Certification (Healthy Homes, smoke alarms, etc.)

Why Is It Important?

Even well managed properties can fall behind on compliance. A Rental Health Check helps you:

- Avoid fines and legal issues

- Improve tenant satisfaction and retention

- Maximise rental income

Who Is It For?

- Private landlords who want expert feedback

- New investors unsure about compliance

- Experienced owners looking to optimise returns

Whether you manage your own property or use a property manager, this check is designed to support you, not sell to you.

How to Book

Booking is easy. Visit our website or give us a call to arrange a time that suits you. One of our experienced team members will assess your documentation and compliance, and provide a clear summary of findings, no strings attached.

👉 Book your free rental health check

Or call us on 03 358 9088 to chat with our team.

How We Can Help (No Pressure)

At First National Progressive, we understand that every investor is different. Some prefer to manage their own properties, while others want a trusted team to take care of everything. Wherever you sit on that spectrum, we’re here to support you.

Our property management services are designed to make your life easier, protect your investment, and help you get the most out of your rental.

What We Offer

Here’s how we help landlords and investors across Christchurch:

-

Tenant Screening

We find reliable tenants through thorough background checks, rental history, and employment verification. -

Rent Collection & Arrears Management

We handle payments, follow up on missed rent, and manage disputes professionally and legally. -

Maintenance Coordination

From urgent repairs to routine upkeep, we work with trusted local contractors to keep your property in top shape. -

Regular Inspections

Scheduled every 3 months, with detailed reports and photos to keep you informed. -

Legal Compliance

We stay up to date with tenancy laws and Healthy Homes Standards so you don’t have to. -

Transparent Communication

You’ll always know what’s happening with your property, with clear reporting and easy access to our team.

No Pressure, Just Support

We’re not here to push you into anything. If you’re curious about how we work or want to explore options, we’re happy to chat, no obligation, no pressure.

Whether you’re managing one property or building a portfolio, we’re here to help you succeed.

👉 Visit our Investor Support Services page

📞 Or call Glen on 021 770 586

Lets Talk

Thanks for Reading – Let’s Stay Connected

We hope this guide has helped you feel more confident about investing in Christchurch’s rental market, whether you’re just starting out or looking to grow your portfolio.

At First National Progressive, we’re passionate about supporting property investors with honest advice, practical tools, and a team that genuinely cares about your success.

If you’d like to:

✅ Book your Free Rental Health Check

✅ Chat about your investment goals

✅ Get help managing your property

✅ Or simply ask a few questions...

We’re here when you need us, no pressure, no obligation.

Get in Touch

Website: fnproperty.co.nz/investor-support-services

Phone: 021 770 586

Email: glen@fnproperty.co.nz

Let’s make your investment work smarter, not harder.

Our Property Experts...